Are Bank Deposits Safe?

Published On: May 15, 2023

Written by: Ben Atwater and Matt Malick

America’s banking system is under pressure. Since Silicon Valley Bank failed back in March, investor and depositor confidence in financial institutions, particularly community and regional banks, has waned.

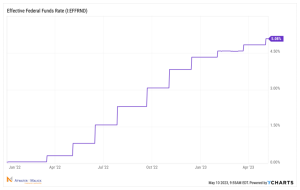

The U.S. Federal Reserve caused the banks’ woes by rapidly tightening monetary policy. In order to battle inflation, the Fed raised the Federal Funds Rate from 0% to 5% in just over a year.

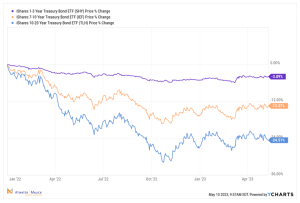

As interest rates climbed, bond prices plummeted, including Treasury securities that represent a meaningful portion of bank assets. The chart below shows the pain across short, intermediate and longer-term Treasuries.

Despite higher interest rates, banks have been loath to raise interest rates paid on deposits in order to preserve their net interest margins, the difference between interest earned on loans and interest paid to depositors. As a result, Treasuries and money market mutual funds offer much higher yields than most bank accounts. The chart below shows current average yields on bank savings and money market accounts versus 3-month and 2-year Treasury yields.

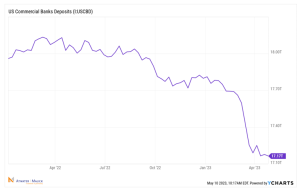

Aware of banks’ falling asset values and tempted by higher yields elsewhere, depositors are pulling deposits, leading to a classic run on more than a few banks. Total bank deposits are down by almost $1 trillion over the last 13 months, which doesn’t fully reflect the acute pain among many regional banks since some depositors simply shifted cash to the “too big to fail” banks like JPMorgan, Bank of America, etc.

Given all this turmoil in the banking sector, some clients are now wondering 1) whether their deposits are safe and 2) whether they should seek out higher yields elsewhere.

As for the safety of deposits, it’s important to keep balances at any one bank under Federal Deposit Insurance Company (FDIC) limits. Through the FDIC, the U.S. government guarantees bank deposits of up to $250,000 per depositor, per insured bank, for each account ownership category. And you don’t have to purchase deposit insurance. If you open a deposit account in an FDIC-insured bank, you are automatically covered.

The “ownership category” distinction is key. For instance, a married couple could maintain $750,000 in insured deposits at each FDIC member bank by holding $250,000 in each individual name and another $250,000 in jointly titled accounts.

It’s possible that the FDIC may increase the insured limit for all banks or continue insuring unlimited deposits for banks that do fail, as they did for Silicon Valley Bank. But we would advise caution and always stay under current FDIC limits.

On the topic of maximizing yields, a number of banks offer competitive savings and money market rates currently. Bankrate.com is a good source for the best rates and shows some banks paying almost 5%. However, clients who keep all their accounts at one bank may want to weigh a higher yield against the convenience of having everything under one roof.

Lastly, for clients who may have more than they need sitting in the bank, the current rate environment affords plenty of opportunity to build individual bond portfolios with attractive yields and low duration. We encourage you to reach out to us to discuss your specific scenario.

Mar 21, 2024

Feb 27, 2024