Diversification

Published On: August 29, 2019

Written by: Ben Atwater and Matt Malick

By and large we’ve built our investment portfolios with individual stocks and individual bonds, mostly avoiding investment products like mutual funds. In our view, this approach is transparent because you can see exactly what you own. Additionally, we see our strategy as low cost because our clients pay one single management fee instead of a portfolio level fee plus a second layer of management fees for investment products. Finally, we believe using individual securities makes our approach more tax efficient as we avoid unpredictable and uncontrollable capital gain distributions.

Even though we’ve utilized a limited number of individual securities to build portfolios, at the same time, we have been highly cognizant of diversification. We’ve been diligent about owning a basket of companies in all different kinds of businesses, both domestic and international, small and large. For balanced accounts, we’ve created a mix between risky assets and more conservative assets. Part of our risk management strategy is diversification while another aspect involves purchasing companies that we believe have some “margin of safety” to their businesses. These companies are generally well established, dividend paying, free cash flow generating and reasonably valued relative to the broader market.

Diversification is not meant to increase returns, rather the motive behind diversification is to make the risk and emotion of investing less damaging to your long-term goals. Diversification tends to hurt your returns in a bull market because performance during a bull market tends to be concentrated in a narrow category (e.g. Nifty Fifty, Dot.com, BRIC, FANG). Conversely, diversification tends to help you in a bear market by cushioning losses when bull market leadership breaks down.

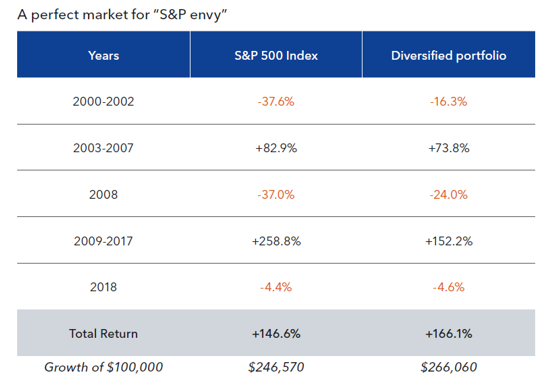

The below introduction and table from BlackRock, the world’s largest asset manager, provides a clear illustration of the benefits of diversification. This study is particularly interesting to us because its time period mirrors that of our careers, so we’ve literally lived this graphic, experiencing the perspective, emotion and reaction of investors at each stage.

“A well-diversified portfolio is designed to help you achieve your long-term goals as well as limit your portfolio’s downs (and ups). But it doesn’t always feel good. You may get upset when you inevitably lose money during certain periods (though your loss is likely less than that of the S&P 500 Index). You may also be disappointed during up markets when you see how well the S&P 500 Index performed, and you didn’t do as well. The good news: a diversified portfolio may produce a better outcome for you in the long-term.”

The investment and economic environment changes unpredictably, but with a diversified approach where we employ transparent portfolios, control fees and minimize taxes, diversification makes it more likely that clients will stay the course and reach their long-term objectives.

Data Source: Morningstar as of 12/31/18. Past performance does not guarantee or indicate future results. Diversified Portfolio is represented by 40% S&P 500 Index, 15% MSCI EAFE Index, 5% Russell 2000 Index, 30% Bloomberg Barclays U.S. Aggregate Bond Index, and 10% Bloomberg Barclays U.S. Corporate High Yield Index. Index performance is for illustrative purposes only. You cannot invest directly in the index. Diversification does not guarantee a profit or protect against a loss in a declining market.

Mar 21, 2024

Feb 27, 2024