Elections Don’t Matter (Part II)

Published On: October 20, 2020

Written by: Ben Atwater and Matt Malick

With the 2020 presidential election dominating the Internet and the airwaves, it’s only natural for investors to be concerned about the relationship between the stock market and the election.

Instead of punditry, we think looking to history is our best bet in evaluating the presidential election and the stock market. In this vein, the other week, we wrote you an email we titled Presidential Elections Don’t Matter (For Markets).

Today, as we continue to see considerable client interest in this topic, we resume this thread and attempt to reiterate the point that elections and political parties do not much matter to markets, despite all the commentary to the contrary.

YCharts, one of our research providers, recently issued a report called “How Do Presidential Elections Impact The Stock Market?”. The report covered areas such as how markets perform when one or the other political party is leading the polls, what happens when polls are wrong about election outcomes, how the market reacts initially and long-term based on the winning political party, what happens when an incumbent or challenger wins and how various asset classes performed under different Presidents.

While all of these areas are interesting, there is insufficient evidence to prove any causation. As a matter of fact, at the conclusion of the YCharts report they summarized their findings succinctly:

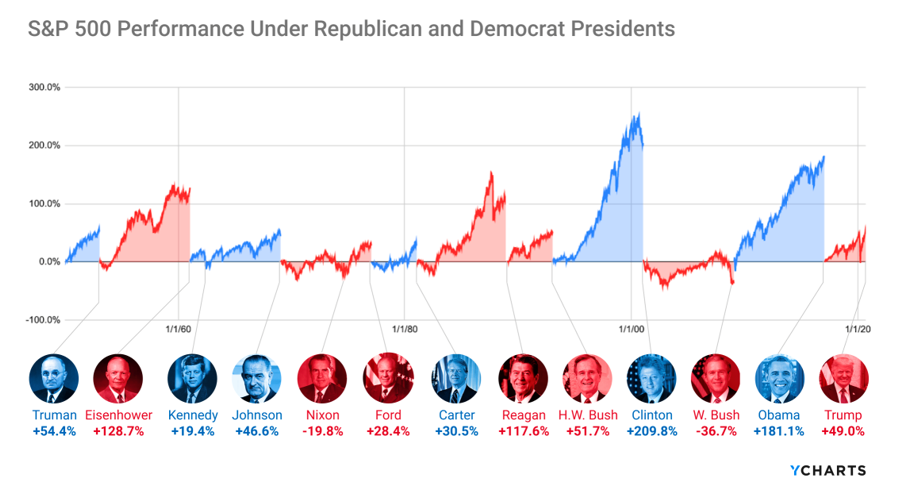

“If you made major investment decisions based on the President’s political party – such as by investing more or less money during Republican or Democratic presidencies – you’re probably hurting your portfolio more than helping it. Shown in the chart [below], the S&P 500 has consistently grown in value over the long-term, no matter who’s in office.”

The most important takeaway for financial advisors and their clients: the party occupying the White House is just one of many variables that can impact your investments. For example, the Dot-com bubble bursting in 2001 and the 2008 Financial Crisis greatly impacted the markets beyond the control of Presidents Bush and Obama, respectively. While elections may create some short-term uncertainty in the market, long-term investing goals and risk tolerances should always be the most important factors in your investment decision making.”

We could not say it better ourselves. Do not invest based on your personal (or anyone else’s) political or economic forecasts. Investing should be based on your goals and proven long-term fundamentals.

We have also come across some new election information from BlackRock, the world’s largest asset manager, that suggests the same general conclusion.

Since 1926, the S&P 500’s average performance during the October of election years was down 0.1% versus all other years up 0.6%; November of election years was up 1.3% versus 1.4% for all other years; December of election years was up 1.7% versus up 1.6% for all other years. These readings are quite similar, presidential election or not.

Investor John Templeton once said “‘This time is different’ are the four most expensive words in the English language.” That has certainly been our experience during our careers.

Of course, things can go off script. Recently a lot of political strategists have been talking about a disputed election, which brings up an interesting question. What happened during our last contested presidential election?

In 2000 the U.S. held its presidential election on November 7th. It’s easy to forget, but it was not until December 13th that Al Gore conceded following a still controversial Supreme Court ruling the day before.

Year-to-date leading up to the election in 2000 the S&P 500 fell 1.6%, during the contested period the market fell 4.9% and in the month after the contested period, the market fell an additional 3%. So, 2000 wasn’t a great year, but it likely had nothing much to do with the election as the dot com bubble first burst in 2000.

We continue to strongly believe there is not much legitimate cause and effect regarding elections and markets.

Mar 21, 2024

Feb 27, 2024