Holding Opportunity

Published On: February 28, 2020

Written by: Ben Atwater and Matt Malick

When reflecting on past stock market washouts, you’ll often hear people refer to them as “buying opportunities.” Historically, they have been just that. However, during a crisis few people look to buy stocks in any meaningful way.

So, we are not going so far as to say the current coronavirus-inspired selloff is a screaming buying opportunity, but let’s start by saying that it’s a holding opportunity. In other words, it’s not time to sell, and it’s not time to go “all-in” on stocks, but it is a good time to hold onto your current stocks.

The reason is simple. Stocks are a volatile asset class that historically delivers high long-term returns but washes out periodically and for reasons that nobody ever predicts. Just as no one predicted coronavirus, no one will predict the rebound either, so to vacate the market in times of stress is to effectively give up on your long-term return potential. If we bail on stocks now, we’re all but guaranteed to miss the inevitable rebound.

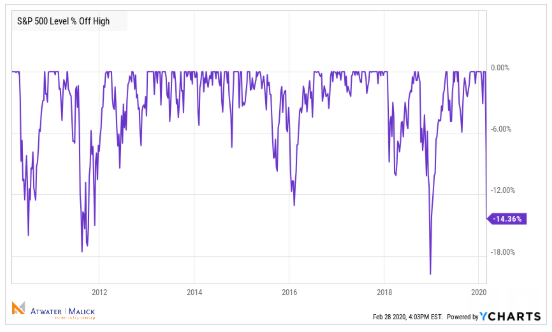

During the last ten years, we’ve seen four other substantial drops.

With a bottom in July of 2010, the market fell 16%. This was the infamous “flash crash,” which most believe to have been computer-generated trading going rogue.

Bottoming in August 2011, the market saw an 18% selloff on fear of a European debt crisis, effectively Europe’s sovereign debt version of the financial crisis. The very survival of the European Union and the European economy were in question.

Ending in February of 2016, the market saw a 13% drop from its highs. This washout came as the British unexpectedly voted to leave the European Union (something that officials still haven’t effectuated).

The biggest drop, to date, of the last ten years ended on Christmas Eve of 2018, with the market falling about 20%. These losses came as a result of the Fed’s plans to raise rates four times in 2019, although they ended up cutting rates three times that year.

That brings us to today, where the market is now more than 14% off its highs based on the fear that coronavirus will spread.

It’s our expectation that coronavirus fears alone will probably lead to a global recession, including a U.S. recession, in which case stock prices are reacting rationally to the outbreak. That said, it’s also very possible that in a few months coronavirus is well contained, and the market is in a full-fledged rebound.

As financial advisors, it should be our number one priority to help you stick to a long-term investment discipline by staying invested. The reality is the last ten years of data, and even hundreds of years of data, suggest that U.S. stock markets recover as unexpectedly as they fall.

Mar 21, 2024

Feb 27, 2024