It’s a Slog

Published On: November 21, 2018

Written by: Ben Atwater and Matt Malick

- Since late September, we’ve been experiencing a volatile stock market. The S&P 500 has fallen 9.61% from its high, the Dow Jones Industrial Average is off by 8.69% and the Nasdaq has swooned by 14.7%. Although the timing was anyone’s guess, this volatility didn’t come as a complete surprise to us. In these email notes, we’ve been pouring cold water on the market for over a year.

- However, most investors that we work with need an equity allocation in their portfolios for the long-term growth potential required to maintain purchasing power (keep-up with inflation).

- Equities are an extremely volatile asset class. 2017, with its low volatility, was an anomaly. What we are experiencing now is normal.

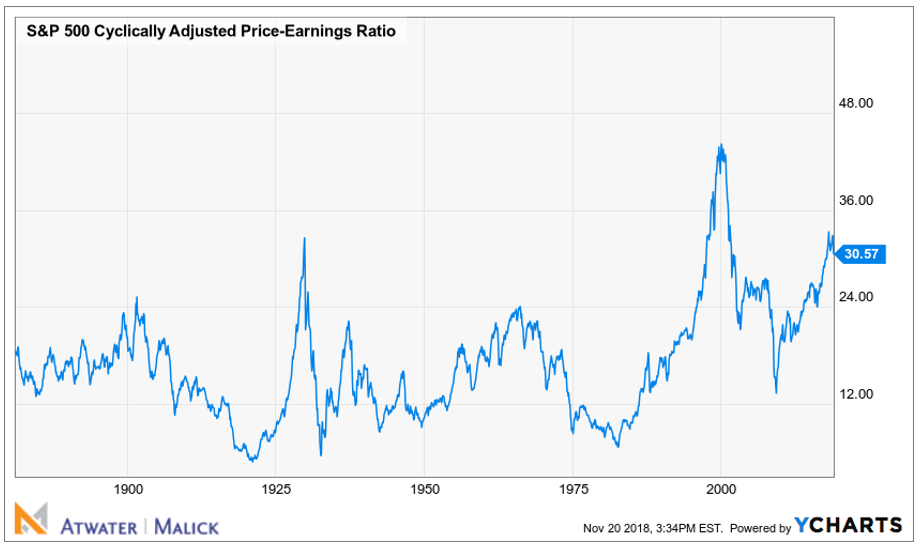

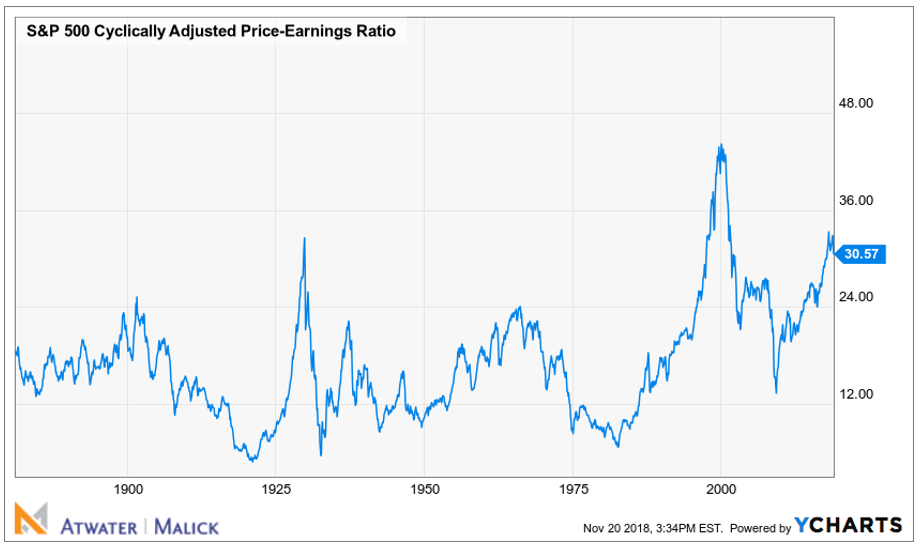

- Stocks are overvalued, as indicated by many valuation metrics, including the 10-year cyclically adjusted price-to-earnings ratio below. Certain pockets of the market, such as large cap tech, are even more overvalued but they have been so for a couple of years. You can’t time the stock market. It’s impossible.

- Although you can’t time the market, you can properly construct portfolios to achieve individual client goals, which is what we do.

- We believe we have an appropriate stock and bond mix in place for each of our clients.

- This stock / bond balance reduces volatility, particularly in this most recent drop as interest rates are again falling (when interest rates fall, bonds prices rise), offsetting some stock losses.

- We focus on more value-oriented stocks that pay a dividend and have a reasonable valuation and we have a “safety-first” bond approach, both of which have limited volatility, while not entirely eliminating it.

- Investing has been “easy” for a few years now. Buying into fairytale stocks and asset classes led to immediate and then sustained gains. This is changing (and that change might be sustained this time).

- Investing isn’t “easy” or even “fun.” It’s a slog. Sticking to a strong discipline like we employ is the best long-term answer.

- We understand that times like now can be stressful and, therefore, we are available to discuss your situation. And, if you know of friends, family or colleagues that need a tried-and-true investment approach, please feel free to share this with them.