Luck. Risk. Behavior.

Published On: June 30, 2021

Written by: Ben Atwater and Matt Malick

When we write about the market, we do so to address what has happened and how it affects our investment approach. We do not claim to know the future. We do not know what is going to happen. And we surely do not know when it is going to happen.

Neither does anyone else. That is vital to remember. The worst thing you can do in markets is attempt to time and predict them. You will lose while long-term and disciplined investors will win.

Of course, people occasionally get lucky and make a prediction that comes true. With investing though, you need to get lucky twice. You need to know when to sell and when to buy back in, or vice versa.

As they say, “lightning doesn’t strike twice.” (In actuality, lightning can strike you twice, but the odds are 1 in 9 million, so do not count on it.)

Being in the market over the last decade has been lucky. We have seen some good times.

However, that does not change the fact that investing in markets (even as a long-term and disciplined investor) is always risky. Lightning can strike anytime. Out of nowhere.

Back in February we wrote you an article entitled Caution. In that piece, we addressed a long list of speculative excesses in markets.

As it turned out, February was the speculative peak in the market. Measures of frenzied risk appetite have fallen since our article. (The timing of our email was, once again, pure luck.)

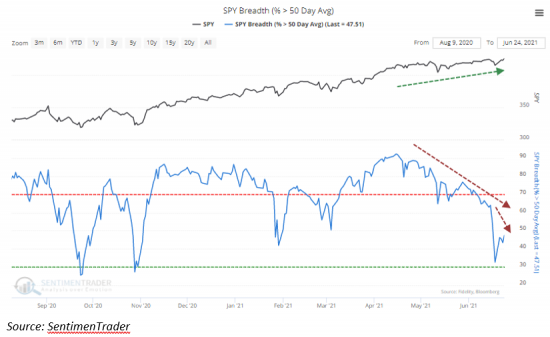

The market on the other hand has remained strong. Despite high levels of speculative excess being a negative, the overall breadth of the market has been quite robust.

Strong breadth means that as the market has risen, so have most of the stocks that make up the market. This does not always happen. Rather, commonly, especially toward peaks, only a smaller number of select larger capitalization companies drive the market higher.

Broad participation, which we have seen, is a healthy sign and counters the speculative excesses.

The most recent market high last week, however, came without solid breadth.

Instead, we experienced a big divergence with a new high in the market while most stocks did not move above prior levels. This could be a worrying sign.

Historically, a fall in speculative excess followed by a drop in breadth has been a negative sign for future returns (1929, 1959, 1963, 1972, 1998 and 1999).

Although this is historically the case, we do not know if it will be the case this time. After all, sample sizes with virtually any modern market indicator are generally insufficient. Not to mention breadth could literally turn around tomorrow, reversing the indicator.

Which leads us to the behavior part.

Clearly this is not a science. Instead, we must always be prepared (mentally and financially) for a major market pullback. When it happens, we need to stay the course and stick to our investment discipline. This bull market will not last forever.

For now, though, let us hope our luck holds and markets go up a lot more before they go down again. Regardless, we have a strong, repeatable, disciplined, fundamentals-based strategy that we must adhere to through thick and thin.

Mar 21, 2024

Feb 27, 2024