Markets Might Work

Published On: May 20, 2021

Written by: Ben Atwater and Matt Malick

As we see a broad-based pullback in asset markets, the go-to explanation among experts is the current inflation scare. We wrote to you about this scare last week.

Although we tend to fall in the camp that this bout of inflation is transitory, we also recognize that markets are positioning themselves for the possibility of higher future inflation.

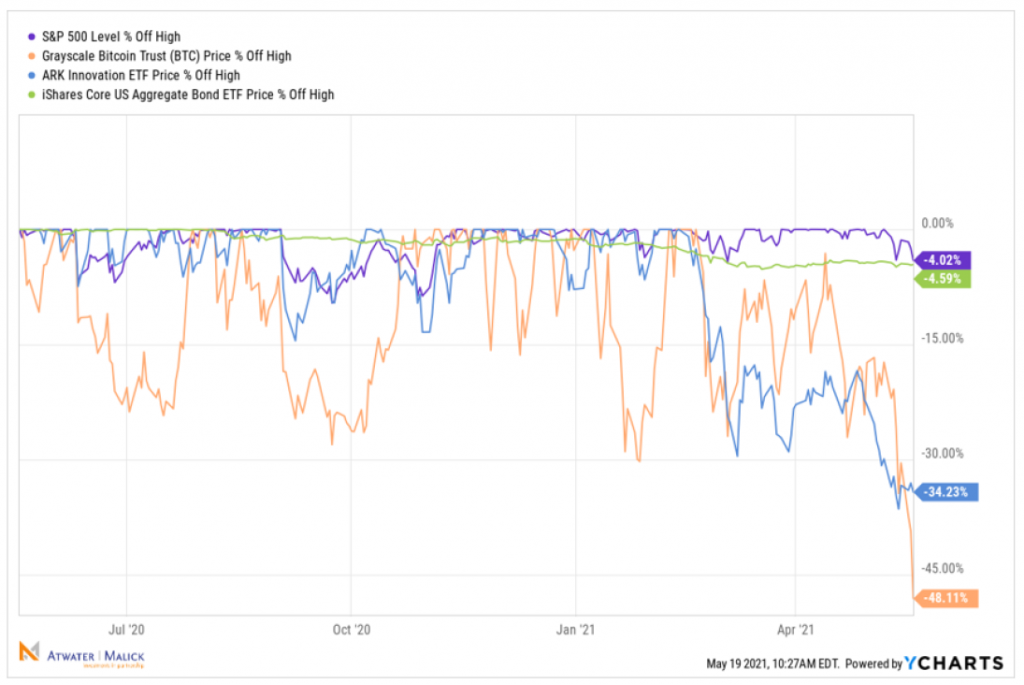

The S&P 500 Index (purple line) of the largest stocks in the U.S. is falling because if inflation persists, then interest rates will continue to rise. Higher rates reduce the value of stocks, which in theory is the present value of future earnings. Discounting future earnings at a higher interest rate makes the present value (or current price) lower.

The U.S. Aggregate Bond Index (green line), which is a broad-based index of U.S. investment-grade bonds, is falling because bond prices and interest rates are negatively correlated. As interest rates rise, bond prices fall.

Core equities and fixed income are bleeding a bit, but not yet gushing. This is appropriate. There is no emergency yet.

After all, most of the holdings in these indexes do have an intrinsic value. In other words, regardless of the level of inflation, they generate somewhat predictable cash flows on which to base a valuation.

However, even moderately recharged inflation will most certainly reduce the record-breaking liquidity the Federal Reserve and the U.S. Congress have injected into the financial system over the prior thirteen years.

These unprecedented levels of stimulus in the system ultimately sent people to dark corners of the market in search of speculative returns. With the prospect of inflation, and thereby the potential to restrict future money creation, the most speculative investments are potentially most vulnerable.

The recent drop in the Grayscale Bitcoin Trust (orange line) has been substantial. This fund is currently trading at about a 20% discount to its net asset value, which means the underlying Bitcoin the fund owns is worth about 20% more than the price of the Bitcoin Trust. This discount implies that this corner of the market is predicting further drops in the price of Bitcoin.

The Chinese government has helped spur the recent selloff in Bitcoin, characterizing Bitcoin in recent days as “not a real currency” that “should not and cannot be used as currency in the market.”

A few weeks before, Tesla CEO Elon Musk suggested the opposite on Twitter, that Bitcoin is a real currency. However, after Tesla pocketed a profit of more than $100 million following his Tweet, Musk largely reversed himself over the last several days. Apparently, securities laws either do not to apply to crypto currencies or to Mr. Musk himself. Regardless, Bitcoin is not functioning as a currency nor a store of value.

Lastly, we will highlight the Ark Innovation ETF (blue line). This fund, managed by the popular and controversial investor Cathie Wood, is a collection of mainly unprofitable tech companies. The ETF’s current holdings have a projected price-to-earnings ratio of about 84 and a median return on equity of about -10%. To give you a sense of Ms. Wood’s outlook on “innovation,” her price target on Bitcoin is $500,000. Whether or not she is correct is likely a good barometer for the future of Ark Innovation.

Meanwhile, we remain committed to being the most boring investors we can be. It seems to be the best path through all cycles. Our portfolios represent assets with intrinsic values which we believe can withstand volatility and offer opportunity if markets continue to correct.

Mar 21, 2024

Feb 27, 2024