Retirement Plan Contributions

Published On: April 6, 2022

Written by: Ben Atwater and Matt Malick

It is once again tax filing time, a good moment to pause and think about whether you are on track with your annual retirement contributions. In this season, most notably, you must make 2021 Traditional IRA and Roth IRA contributions before your personal tax filing deadline, which is April 18, 2022 for most filers.

And with more than a fourth of 2022 behind us, it is also a wonderful time to evaluate not only if you can still make 2021 contributions, but if you are on schedule for your 2022 contributions.

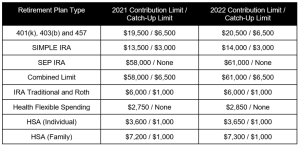

For U.S. workers, the most popular method of saving for retirement and healthcare is in qualified plans and other tax-advantaged accounts. These plans take on a variety of names, numbers and acronyms and each has its own rules, including various contribution limits. You must have earned income to contribute to these plans. Here is a summary of plans and the contribution limits for 2021 and for 2022.

The age for catch-up contributions to 401(k), 403(b), 457, SIMPLE, Traditional and Roth IRAs is 50. For HSAs, the catch-up age is 55. Your modified adjusted gross income may limit your deductibility of traditional IRA contributions and eligibility for Roth IRA contributions. Contact us to discuss whether contributions make sense for you.

The due date for contributions is generally your tax filing date plus extensions for your plan, your business or your individual return. For example, employee deferrals for a plan that stands on its own, like a 401(k), is year-end while employers have until their tax filing deadline to make matching contributions. For a SEP plan, if tied to a distinct business entity, it is the entity filing date. For an IRA, which is an individual plan, the contribution window ends at the individual taxpayer’s filing deadline.

Maximizing plan contributions, to the extent possible, should be your first tier of retirement savings. If you need any assistance on how to best maximize your contributions, whether they be at work or with us, please contact us.

Mar 21, 2024

Feb 27, 2024