Risk Premium in Two Charts

Published On: December 27, 2018

Written by: Ben Atwater and Matt Malick

If any investors had forgotten about the concept of risk in financial markets, the stock market has reminded us over the last few weeks. According to Investopedia, an online source for market lingo, risk “is broadly characterized as the chance an outcome or investment’s actual return will differ from the expected outcome or return.” In other words, it’s the potential to lose money when you expect to make a profit.

Fewer investors are familiar with the concept of risk premium. Risk premium explains why stocks, historically, return more than bonds or cash over a long period of time. We’ve mentioned this concept before in client notes, explaining that volatile times like these are the very reason why equity investors earn a higher rate of return in the long run.

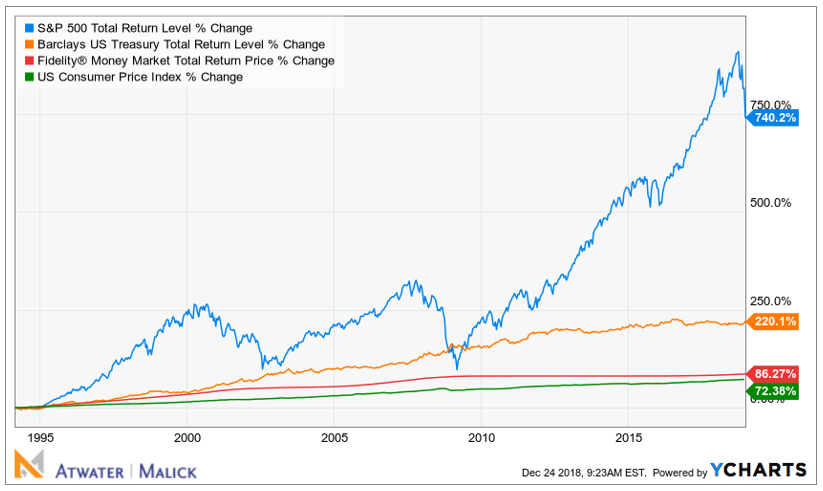

The chart below illustrates total returns (price appreciation plus reinvested dividends / interest) for the S&P 500 (blue), the Barclays U.S. Treasury index (orange) and a sample money market fund offered by Fidelity (red), all going back nearly 25 years. The S&P 500’s total return has more than tripled that of Treasuries and is over eight times the return of the money market fund, which barely outpaced inflation (green).

Although patient stock investors were rewarded over this time, it was anything but smooth sailing. The chart below shows peak-to-trough drawdowns along the way, with equities suffering many fits and starts, including two 40%-plus bear markets in 2000-2002 and 2008-2009. By comparison, bonds saw very minor drawdowns and the money market fund never lost money. Lower volatility was directly related to lower long-term returns.

When markets are rocky, it’s very important to remember two things:

First, stock market declines are completely unpredictable. We have been pessimistic about stocks since the Spring of 2017, but the timing is pure guesswork. When market conditions seem too rosy or too dour, stay level-headed, maintain an appropriate long-term asset allocation and rebalance as appropriate.

Second, long-term stock investors are rewarded for their patience with compelling long-term returns. Since nobody can predict the periodic drops, the only alternative is to patiently ride out the storm, stick to your long-term plan, and rebalance as appropriate.

Ironically, as losses accelerate here, investors may be inclined to sell. That is the opposite of what you should be doing. In reality, equities are now about 20% more attractive than they were in September. Rather than panicked selling, it is prudent to rebalance back to your target asset allocation by using bond maturities and other cash flows to add to beaten-down stock positions.

Mar 21, 2024

Feb 27, 2024