Roth Conversions – 2022 Edition

Published On: May 23, 2022

Written by: Ben Atwater and Matt Malick

As long-term investors, we must occasionally suffer through bouts of volatility and steep equity losses. The tradeoff is that stocks have historically delivered robust long-term returns because of this turbulence along the way.

During periods of sharp declines, however, investors can sometimes take action to improve their long-term tax situation.

One such move is a Roth IRA conversion.

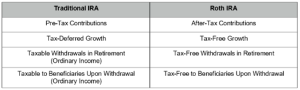

With a traditional IRA, contributions are tax-deductible (pre-tax), the funds grow tax-deferred until retirement and the IRS taxes withdrawals as ordinary income. With a Roth IRA, which the Taxpayer Relief Act of 1997 established, the IRS does not permit a current income tax deduction when you make contributions, but the contributions grow tax-free, and withdrawals are tax-free.

A Roth conversion allows an investor to convert pre-tax funds from a traditional IRA to a tax-free Roth IRA. However, the IRS taxes the amount converted as ordinary taxable income in the year of the conversion.

A Roth conversion rarely makes sense because, instead of paying taxes on traditional IRA withdrawals over the course of a multi-decade retirement, you pay the taxes up front, often pushing you into a higher tax bracket.

Under the following circumstances, however, a Roth conversion can work well.

Depressed Stock Market

Consider an investor who had a $200,000 IRA on December 31, 2021, and the value has now dropped to $160,000. If this investor performs a Roth conversion now, he will report $160,000 in ordinary income on his 2022 tax return.

Please note, investors can convert a portion of their regular IRA. For example, if you have a $2,000,000 IRA, you can choose to convert a portion of it. In other words, it is not an all or nothing proposition.

The income tax liability on this much additional income is clearly nothing to sneeze at, but the future tax benefits are compelling.

Ideally, the investor who converts the $160,000 sees their conversion amount grow again in the next bull market. The investor can then withdraw the full account value, including all future appreciation, tax-free in retirement. If the investor dies with a balance left in his Roth IRA, his beneficiaries can also withdraw the funds tax-free.

Cash on Hand

The primary cost of a Roth conversion is the ordinary income tax due on the market value of the conversion. And to pay this tax due when you file your 2022 taxes, you should have the cash on hand. This is a key component for the conversion to make sense.

If we assume our hypothetical IRA investor above has an effective tax rate of 25% on the Roth conversion amount of $160,000, his tax bill would be $40,000.

Because of the current income tax obligation, Roth conversions tend to work best in years when other taxable income is depressed. For this reason, retirees are often prime candidates.

Higher Future Tax Rates

Although we caution against higher future tax rates as a primary motivator, Roth conversions also work well if the current rate of taxation on the converted amount is lower than the rates Congress will apply to future IRA withdrawals. For example, if our investor’s current effective tax rate is 25% but he expects the federal government to raise marginal tax rates in the future, then it may behoove him to do the conversion now and lock in the lower rate.

Just like anything in the future, tax rates defy prediction, so be careful that your motivation is multifaceted, like a depressed market, depressed income and available cash on hand to pay the current tax liability. If this triple play is in place, then higher future tax rates materializing is icing on the cake.

New Inherited IRA Rules

Among the provisions of the SECURE Act, a retirement bill that became law on January 1, 2020, was a change to the treatment of inherited IRA accounts.

Under previous rules, non-spouse beneficiaries of traditional IRAs could stretch out required minimum distributions over their lifetimes. For example, if our investor named his 50-year-old daughter as his sole traditional IRA beneficiary, she would calculate a required minimum distribution each year, based on her life expectancy of over 30 years. Under the SECURE Act, she must withdraw the full value within ten years, diminishing her ability to defer income taxes.

The SECURE Act also requires that most non-spouse Roth IRA beneficiaries withdraw all funds within ten years. But for Roth IRA beneficiaries the withdrawals are completely tax-free at any time during this period.

All things being equal, if you are unlikely to spend your IRA in your lifetime, and your primary motivator for your IRA funds is to provide an inheritance to your non-charitable heirs, a Roth conversion is something to consider.

Conclusion

Roth conversions are not for everyone. In fact, in our view, advisors too often recommend them. But if you have a traditional IRA (or 401(k) that is eligible for a rollover) and . . .

1. The market is depressed

2. Your annual income is below normal

3. You have after-tax cash with which to pay current income taxes

4. You think future tax rates will be the same or higher

5. You do not need your IRA for retirement and prefer to better prepare it for non-charitable heirs

Then, a Roth conversion might just be for you.

We will be reaching out individually to clients who we think can benefit from this planning opportunity, however, if you find this a compelling idea for your situation, please reply to this note so we can start the conversation sooner rather than later.

Mar 21, 2024

Feb 27, 2024