Tax Documents

Published On: January 27, 2022

Written by: Ben Atwater and Matt Malick

We know that for many clients waiting for tax information is stressful. Although “waiting is the hardest part,” we also understand that providing guidance as to when your information will be ready can prove reassuring. So, in that spirit . . .

As a reminder to our clients who moved custodians from Fidelity to Schwab in 2021, you will receive tax reporting information from both Fidelity and Schwab. Therefore, please pay careful attention to the instructions for both custodians. If you need any assistance, do not hesitate to contact us as we recognize that this is a logistical challenge for this tax season.

If you receive paper statements, it is likely you will receive paper tax documents through the U.S. mail. If you receive electronic statements, then you will receive an email notification regarding available tax document(s). It’s important to note that if you have multiple accounts, all of your tax forms won’t be ready at the same time.

Fidelity

For those accessing tax documents on Fidelity.com, login to your profile, go to the Accounts & Trade tab, click Tax Forms & Information and then click View Your Tax Forms. Each of your tax forms will either show completed or will give you a “Check back” date.

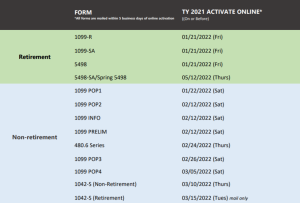

Below is a schedule when Fidelity tax documents will be available:

Charles Schwab

For those accessing tax documents on Schwab.com, login to your profile, go to the Accounts tab, click Statements, then click Tax Forms, then click Search.

Most Charles Schwab tax documents will be available in mid-February.

Charles Schwab also allows you to track your 1099 availability online. Schwab’s 1099 Dashboard provides a quick, personalized way to view the expected delivery dates of 1099 forms.

Please feel free to contact us with questions or concerns. Thank you working with us. We truly appreciate your trust and confidence.

Mar 21, 2024

Feb 27, 2024