The 1970s

Published On: May 10, 2022

Written by: Ben Atwater and Matt Malick

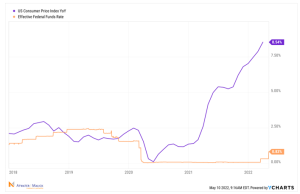

The current economic environment has shades of the 1970s. Much like today, the 1970s economy saw high energy prices, persistent inflation, rising interest rates and slowing growth. Only this time around, the Federal Reserve may be late in launching the battle against inflation.

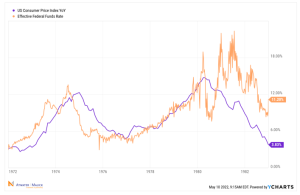

In the early 1970s, the Federal Reserve raised the Fed Funds rate in lockstep with inflation. Inflation subsided somewhat before skyrocketing again in the late 70s and early 80s. But the Fed continued raising its benchmark rate as the consumer price index (CPI) spiked, with Fed Funds ultimately far exceeding the inflation rate as Federal Reserve Chairman Paul Volcker successfully stamped out runaway inflation for a generation.

This time around, the Fed may be behind the curve. By the time inflation reached 8% in November 1973, the Fed Funds rate was already north of 10%. This time around, the Fed Funds rate is still below 1%.

Nobody knows for certain what it will take to tame inflation this time. Perhaps the Fed will pay a price for letting inflation run so hot before beginning to hike. Interest rates may continue their ascent, driving the global economy into recession and punishing both stock and bond holders.

Or maybe supply chains will improve, China will change tack on its zero-COVID policy, chip makers will increase production capacity, free trade will resume as the U.S., China and Europe drop tariffs and Ukraine will drive Russia out or negotiate peace. Any one of these events would certainly help alleviate inflationary pressures.

Because we can’t predict the future, timing the market is futile. We should instead stick to a long-term discipline that has worked through past market cycles.

Back to the 1970s inflationary cycle, what did stocks and bonds do then? We looked at three long-running mutual funds for a guide.

The Fidelity Fund (FFIDX), which is Fidelity’s oldest mutual fund and invests in common stocks, saw meager price appreciation of just 13.51% from 1972 through 1982 or 1.16% annually. But when you include reinvested dividends, the total return was 180.1% or 9.82% annually. In other words, staying invested in equities that paid dividends and then reinvesting those dividends produced robust returns.

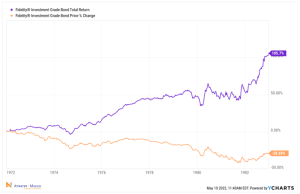

The Fidelity Investment Grade Bond Fund (FBNDX), Fidelity’s oldest bond mutual fund, suffered persistent price declines throughout the same period, losing 28.69% or 3.03% annually. This is to be expected because when interest rates rise, bond prices drop, all things being equal. But when you include reinvested interest (coupon) payments along the way, investors enjoyed a 105.70% cumulative gain or 6.78% annually. In other words, staying invested in bonds and reinvesting interest and maturities into new bonds with higher yields delivered solid returns.

Lastly, for a look at a balanced portfolio, the Vanguard Wellington Fund (VWELX), the world’s oldest balanced mutual fund, also suffered price depreciation from 1972 through 1982, falling 5.32% or 0.50% annually. But including reinvested dividends and interest, an investor enjoyed cumulative returns of 123.3% or 7.58% annually. In other words, staying invested in both stocks and bonds, reinvesting dividends, interest and maturities and maintaining a balanced asset allocation produced strong returns that helped investors keep up with inflation.

We realize that turbulent markets are often stressful. Even when history suggests that you stay the course, it can be easier said than done. If you would like to discuss your personal portfolio and investment strategy, please do not hesitate to reach out.

Mar 21, 2024

Feb 27, 2024