The Value of Investing, Revisited

Published On: December 6, 2018

Written by: Ben Atwater and Matt Malick

Following a Monday stock market rally on the hopes for a U.S.-China trade deal, equity losses once again intensified Tuesday. Today U.S. markets are closed for the George H.W. Bush National Day of Mourning. There is no doubt that volatility has returned, and many investors are suffering from heartburn.

Despite all the market gyrations in recent months, investors have not made any headway in 2018. Domestic equities are flat to negative, international equities are in the red nearly across the board, and even bonds are suffering losses this year as interest rates have risen.

In times when gains are hard to come by, it’s always helpful to take a step back and consider why we invest in the first place. In July of 2009, just 4 months into an equity bull market that has run for nearly ten years, we penned a client update entitled “The Value of Investing,” specifically to address this question. We are providing excerpts from the update below (in italics) along with some updated commentary. (The complete original essay appears on page 150 of our book, The Disciplined Contrarian.)

Over the past 100 years, stocks have created great wealth for Americans. There are common examples of individuals who amassed fortunes from stock investments, such as Warren Buffett. But there are anecdotal examples as well. One investor who we met several years ago turned a lucrative 1950’s era sales commission of $5,000 into a $10 million nest egg through diligent investments in “blue chip” U.S. companies over 5 decades.

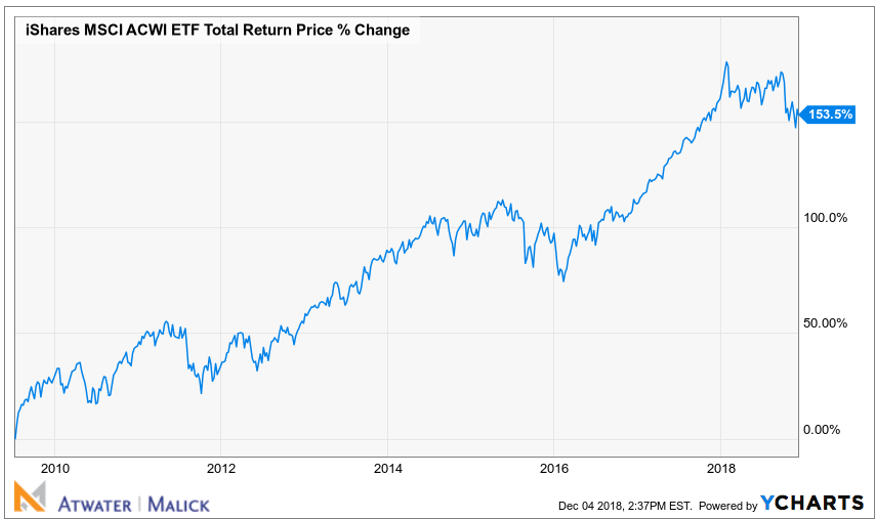

If a similar investor had tracked the most common global equity benchmark, the MSCI All-Country World Index, since we wrote the original update, his $10 million nest egg would have grown to $25,350,000. With the benefit of hindsight, it’s easy to see the logic of long-term equity investments. But in the moment, like when we originally wrote this piece, on the heels of a major financial crisis, the future looked quite cloudy.

Professor Jeremy Siegel of the Wharton School estimates that the compound average annual real return (after accounting for inflation) of stocks has been about 7% since 1802. These are powerful returns for a 200-plus year period that includes a civil war, a Great Depression, two world wars, numerous recessions, and countless other impediments to economic growth and stability. Through it all, though, the U.S. economy has consistently delivered excellent results.

There are few other opportunities to achieve this kind of long-term growth. Sure, an enterprising individual who starts or purchases a business or invests in a lucrative piece of real estate can achieve hefty returns. But, this sort of investment requires a significant capital outlay and will carry the higher level of risk associated with a concentrated investment. Additionally, investors are limited in the types of investments that can be practically made in tax-advantaged accounts that are commonly used to save for retirement, such as IRA’s.

When you view equities over very long periods, the advantages provided to individual savers from investing are obvious. Perhaps the more often overlooked beneficiary is our American society as a whole. In a broad sense, stock investing should serve to allocate capital efficiently to well-run businesses. Individual investors and their advisors literally help corporations raise capital to expand their operations, fund research and development efforts, create new and better products, and ultimately contribute to the growth of our economy. In other words, investment raises the capital that funds innovation. This is a vital component to an increasing standard of living for Americans.

This system is far from perfect, and capital is occasionally allocated to poorly-run businesses in times of heavy speculation – think Pets.com during the technology bubble or Countrywide Financial during the real estate bubble. But eventually these problems work themselves out and capital is ultimately shifted to true innovators.

If current market volatility snowballs into a full-fledged bear market, there will inevitably be new examples of overvalued stocks falling back to reasonable valuations or even failing. It’s for this reason that we have avoided growth stocks sporting lofty price-to-earnings ratios and negligible or nonexistent dividend yields during this bull market run. Rather, our investment discipline favors established businesses trading at reasonable valuations, generating healthy free cash flow and returning it to shareholders in the form of dividends and share repurchases.

We strongly believe in this system, which is one of the many reasons we invest independently. In order to fully understand the value of investing, it is imperative to know what you own and why you own it.

As our business has grown, we have increasingly paired goals-based financial planning with our unique investment approach. It’s important to remember that the two go together. Nobody can invest effectively without first setting financial goals. These goals may include generating “income” during retirement, saving for college or passing on a legacy to heirs. But without a disciplined investment process, it’s unlikely that any investor will reach their long-term goals.

In times of market volatility, it’s more important than ever to employ a transparent investment approach in which you “know what you own and why you own it.”

Mar 21, 2024

Feb 27, 2024