The Waiting

Published On: June 2, 2022

Written by: Ben Atwater and Matt Malick

“The waiting is the hardest part / Every day you see one more card / You take it on faith, you take it to the heart / The waiting is the hardest part”

– The Waiting, by Tom Petty and The Heartbreakers

In the simplest terms, an investment’s success or failure boil down to a handful of cash flows.

First, there is an initial outflow to purchase an investment, hopefully at a fair price.

Then, throughout the life of the investment, there may be cash flows to and from the investor. For example, a stock may pay cash dividends and a bond typically makes coupon payments. Real estate investors may receive rental income, incur maintenance expenses and pay property taxes.

And lastly, there is a final cash flow when the investor sells, ideally at a price higher than the initial outlay, and the investor would then realize a capital gain.

When investing in marketable securities, which the market prices on a second-by-second basis, along the way there will be noise. Stock and bond prices will experience large fluctuations and the news cycle will impart feelings of greed, optimism, fear and pessimism. But the core cash flows are what matter to the investor.

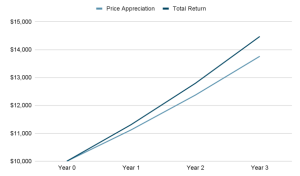

Consider a $10,000 equity investment made three years ago. Let us assume the investment has grown to $13,760 over three years. And let us also assume that it paid cash dividends throughout the three years that, when reinvested, would have grown the initial investment to $14,470. This would represent a 13.10% annualized rate of return.

If the above were the chart of that investment, we would all take it in a heartbeat. No gyrations, no uncertainty and no stress. Just steady, positive cash flows and price appreciation.

Alas, that level of steady return does not exist. Instead, above is the chart of the S&P 500 over the last three years, which produced the same cash flows and the same result. But a patient investor experienced a pandemic-induced bear market, an unexpectedly fierce recovery and the bear market scare that we are currently experiencing. That is volatility!

The hard part over the past three years was the waiting. In March of 2020, COVID-19 turned the world upside down and it was difficult to hold onto stocks while waiting for an uncertain recovery. And in 2021, the fear of missing out tempted investors to speculate on cryptocurrencies and “meme stocks” that kept going up in price despite having no cash flows or underlying value.

Not all 3-year periods will see positive returns. But history shows the market will reward an investor who shows patience. The waiting is the hardest part.

Mar 21, 2024

Feb 27, 2024