Three-Headed Monster

Published On: March 28, 2023

Written by: Ben Atwater and Matt Malick

Today, the U.S. Federal Reserve’s Open Market Committee announced its most recent interest rate decision. The Fed is certainly a lightning rod for criticism, and perhaps rightly so. Although perhaps any institution with a high profile and a terribly difficult job will tend to elicit controversy.

The Feds’ job is abstruse and even contradictory. The Fed, in all reality, has three mandates. Responsibility for price stability, for full employment and for a safe and resilient banking system. As the Fed contemplates its next interest rate decision, let’s examine each of the three.

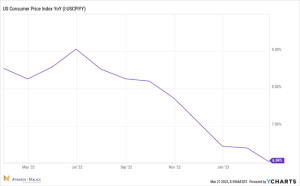

As for price stability, the Fed has made progress in its fight against inflation since initiating a series of rate hikes on March 16, 2022. Inflation has fallen by about 30%. Sure, it remains stubbornly high, at just over 6%, but it is moving in the right direction. Experts and academics often estimate that Fed policy changes can take at least 18 months to cycle through and impact the system. There is a real argument that patience is necessary to forestall inflation without killing the economy.

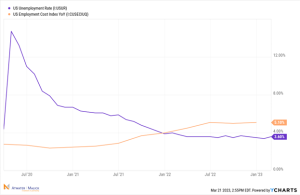

This three-year chart of the unemployment rate, inclusive of the beginnings of COVID, shows us that the unemployment rate remains at historic lows. Theoretically low unemployment is inflationary as companies need to pay-up to hire qualified workers, but even wage inflation has recently leveled-off. The Fed, for better or worse, is experiencing an economy at “full employment”.

As the Fed battles inflation via higher interest rates, a serious unintended consequence has arisen, which comes in the form of a series of bank failures. These failures create concern among investors, who are liquidating bank shares and bank debt en masse. The above chart of the KBW Bank Index, an index designed to track the performance of the leading banks and thrifts that are publicly traded on the U.S. stock market, has tumbled more than 36% over the past year, evidence of this palpable investor anxiety.

The Fed is making progress in its fight against inflation, but the cost, at present, is a banking scare. Higher rates combined with tighter lending among distressed banks will surely continue to cool the inflation rate, while likely also pushing up the unemployment rate. As they say, there is no such thing as a free lunch. Pushing inflation down will have its long-term benefits, but it will also have its short-term costs.

Mar 21, 2024

Feb 27, 2024