Zoom Out

Published On: August 14, 2019

Written by: Ben Atwater and Matt Malick

Business consultants and life coaches sometimes espouse a concept called “Zooming Out” which they use to gain a better perspective on problems. The idea is that we often focus on the minutia of an immediate problem, rather than considering its context in the bigger picture.

Investors are prone to a similar mistake when suffering periods of volatility. In the moment, a market decline can be stressful. We are tempted to seek out strategies to avoid the short-term pain while ignoring the big picture, namely that stocks generate robust returns over long periods of time because they’re volatile.

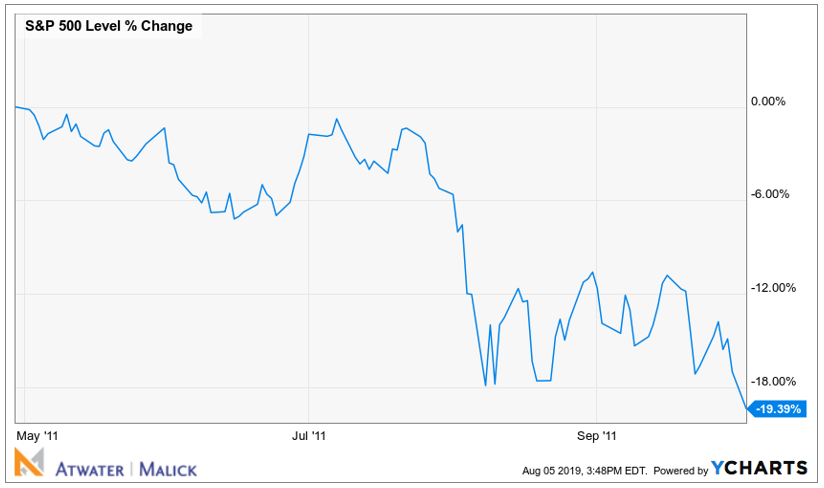

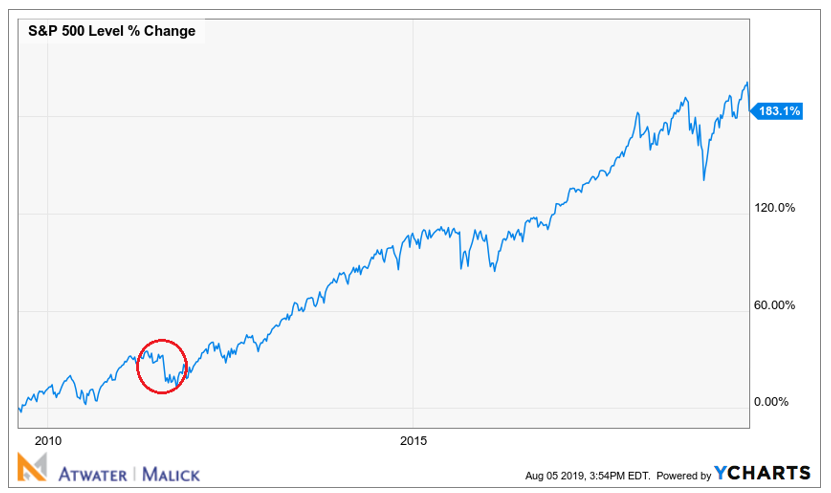

Back in 2011, stocks suffered a nasty correction that very nearly extended into bear market territory. This was the first serious post financial crisis decline and many investors were understandably skittish. We fielded many calls from clients considering bailing on stocks. During this roughly 5-month period, particularly in late summer, the pain was acute.

Fast forward eight years, and unless you follow financial markets closely, most investors would probably struggle to remember what happened in the summer of 2011. Given time and perspective, or after “zooming out,” the 2011 correction was a mere blip on the radar.

Including today’s drubbing, the Standard & Poor’s 500 is just over 6% from its high. In the short-term, nobody knows whether losses will intensify or reverse. But it’s vital to “zoom out” and remember that we have a disciplined investment strategy designed to meet your long-term financial goals, rather than focusing on short-term volatility and the stress it can induce.

Mar 21, 2024

Feb 27, 2024